The forgiveness of fines also affects "Diva", taxpayers who have not paid fines and late interest benefit

The forgiveness of fines and late payment interest provided for in the draft law "On the cancellation, extinguishment and payment of tax liabilities to the central tax administration and liabilities payable to customs" will also include taxpayers who were obliged to declare DIVA, but due to failure to declare on time or late payment have received fines and interest.

This measure creates space for individuals who have not paid their fines on time to have their penalties waived, while the main tax obligation that must be paid is not waived and remains mandatory.

For fiscal experts, the inclusion of this category creates instability in the market by increasing informality.

" In the part of debt forgiveness, we are not talking about tax liabilities calculated by the administration through an audit or by the office, but we are talking about administrative penalties that come for not declaring on time or not declaring at all or such declaration that concerns the entire category of taxpayers, from individuals who declare DIVA to those who are businesses that had an obligation with a certain date to declare it and have not declared it.

All sectors are undoubtedly included, all categories of businesses from the self-employed to large businesses, as well as individuals who have to declare their personal income. They are always forgiven those fines because they may not have obligations those fines and penalties related to failure to declare on time or negligence or ignorance of what needs to be reported and declared, including the Central Bank and other institutions that are related to the declarations of financial statements , "says Eduard Gjokutaj, fiscal expert.

Part of DIVA are individuals who submit an annual personal income declaration, mainly those with a gross annual salary of over 1.2 million lek, both employed for at least one tax period within the year, and those who earn income from other sources over 50 thousand lek per year for which no tax has been withheld at source.

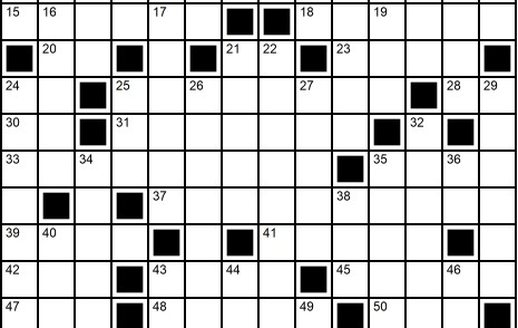

For 2024, the number of individuals who had to complete the DIVA was 144 thousand, while according to the Tax Directorate, only 124 thousand submitted it.

" Of course, such an instrument that deals with the deletion of records is mostly outdated, so it is more of a genuine political decision with the aim of justifying what has been done wrong by luring taxpayers, but at the moment that there is no analysis and there is no reaction in terms of institutional responsibilities, of course this will continue in this form because a law is not enough to address all the problems, as a very transparent and very comprehensive approach is also needed, since honest taxpayers themselves in this case feel mistreated, and on the other hand it lures those individuals who are hesitant to become part of the informal sector ," adds Gjokutaj.

Fines for non-compliance with DIVA range from 3-10 thousand lek plus late payment interest. In total, in 2024, taxes collected from the 2024 individual personal income tax (DIVA) declaration amounted to about 1.7 billion lek or 17.3 million euros, with an increase of 1.4% on an annual basis, according to the DPT.

Happening now...

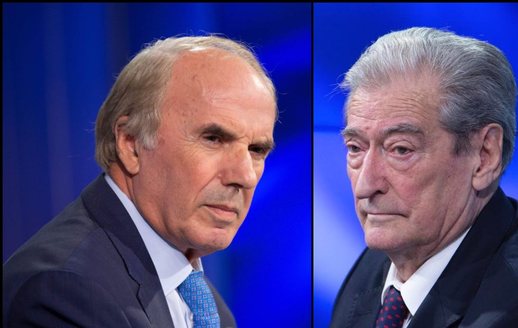

Karmën nuk e ndalon dot Sali Berisha!

ideas

"Topple" Edi Rama by lying to yourself...

Only accepting Berisha's truths will save the DP from final extinction!

top

Alfa recipes

TRENDING

services

- POLICE129

- STREET POLICE126

- AMBULANCE112

- FIREFIGHTER128