Bank of Albania: Challenges for the banking and financial sector are increasing

The Financial Stability Statement for the second half of 2024 assesses that the performance of the financial sector was positive, but in the meantime, challenges for the future are assessed to be increasing.

According to the Bank of Albania Statement, in the second half of 2024, the sector's activity developed steadily.

Deposits and loans expanded despite the dampening effect of the exchange rate appreciation, capitalization of operations remained at good levels, while profit improved significantly.

According to the Bank of Albania, operational risks are assessed at controlled levels and, overall, the banking sector is resilient to them.

However, the Bank of Albania states that the challenges for banking and financial activity are assessed to be increasing, so better financial performance should be used by banks to improve their risk management infrastructure.

Overall, the Albanian economy and the financial system in the country have shown good stability.

Economic developments have been stable, and macroeconomic indicators remain at quite good levels.

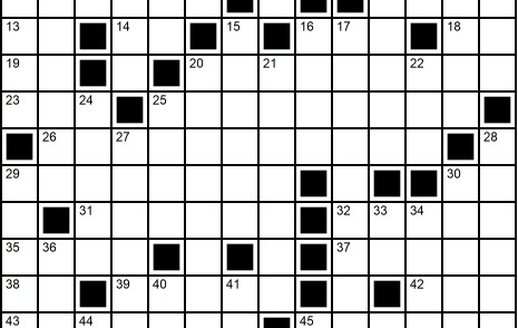

These developments are also confirmed by the Stability Map indicators, which reflect lower and relatively controlled risks in indicators related to households, businesses and government.

Although domestic economic developments appear positive, uncertainty from international developments has increased.

The degree of escalation of trade tensions and the progress of military conflicts in Europe and beyond remains to be assessed, but the Bank of Albania believes that their impact on the continent's economic performance may be higher than before.

If they are accompanied by increased inflationary pressures, falling incomes and declining consumption in the European economy, this is likely to be reflected in the Albanian economy as well.

The main trend may be in the form of a decline in non-resident consumption in the Albanian economy, manifested in the form of a decline in emigrant remittances and foreign direct investment, or even a decline in the export of services.

In the periodic survey conducted with banks, this factor has been identified by them as the main source of risk, followed by vulnerability to potential cyber attacks.

As before, the Bank of Albania assesses that the banking sector should maintain careful monitoring of its exposures in the real estate market, of the maturity gaps between assets and liabilities, and of the impacts of interest rate movements.

Credit growth appears rapid and, although lending standards currently remain good, there is a possibility that they may weaken in the face of competition between banks.

To establish fairer incentives in credit performance, in implementation of macroprudential policy, in December 2024, the Bank of Albania increased the requirement for the countercyclical macroprudential capital buffer to 0.5%./ Monitor

Happening now...

America may withdraw from Europe, but not from SPAK

ideas

Who is the Surrel Rabbit?

The two wrong paths of the opposition with the Ombudsman

top

Alfa recipes

TRENDING

services

- POLICE129

- STREET POLICE126

- AMBULANCE112

- FIREFIGHTER128